Ben

bepaald geen fan van Bill Bonner, echter het volgende artikel van

zijn hand bevat (althans zeker voor mij) aardige gezichtspunten op het

financiële beleid in de VS als instrument om dollars bij te kunnen

drukken en daarmee de waarde van de dollar te verminderen. Zo zou de

huidige dollar volgens Bonner in vergelijking met die van 1971 nog

maar 3 dollarcent waard zijn……

Eén en

ander is het gevolg van de ‘nieuwe dollar’ die in 1971 onder ‘tricky dick’ Nixon werd

geïntroduceerd en waarbij de Fed de macht kreeg om (fiks) dollars

bij te drukken en daarmee de inflatie te voeden…….. Het grootste

deel van het volk in de VS begreep niet waarom hun geld destijds zo

snel in waarde verminderde en gaven de schuld aan de arabieren

(vanwege de hoge olieprijs), echter de energiecrisis van de 70 er

jaren bracht alleen de prijs terug op het niveau van voor de grote

dollar diefstal in 1971* >> de OPEC besloot minder

olie te produceren, waarop de prijzen stegen naar het niveau van

voor 1971…… Zie in het artikel hieronder hoe de inflatie zelfs met dubbele cijfers groeide…… (het is een studie waard om te zien wat het effect van de nieuwe dollar en de infaltie in de VS was op

de Nederlandse economie en die van de ons omringende landen….)

Inflatie

is zoals Bonner zegt inderdaad een instrument om mensen nog meer

belasting te laten betalen, waar de winsten daarvan in de VS vooral

naar de superrijken stromen…… Terwijl 50% van de onderlaag in de VS sinds 1999 30% armer is geworden, stijgen de inkomens van de welgestelden jaar op jaar……

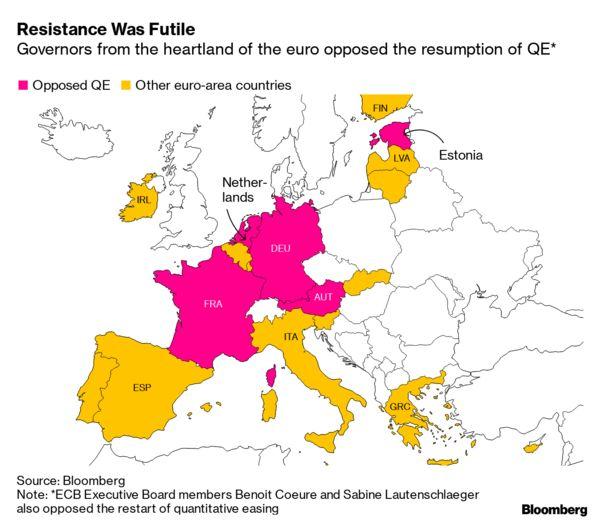

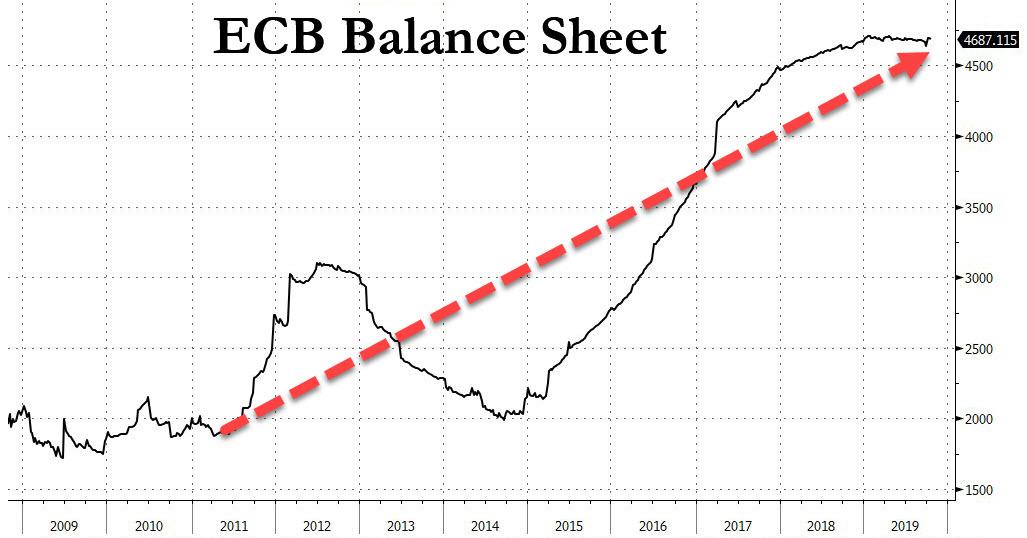

Vergeet bij dit alles niet dat ook in de EU, ofwel bij de Europese Centrale Bank (ECB) de geldpersen al jaren overuren maken……. Een zaak die in feite de ‘EU maatschappij’ steeds verder ontwricht…….

Lees het

artikel van Bonner, overigens onderdeel uit een soort ‘dagboek’, waar

je de link naar het vervolg van het hieronder opgenomen artikel, onder dat artikel terugvindt. Mocht je het interessant vinden dit ‘dagboek’ te volgen, neem dan

het adres van Bonner & Partners of van Money and Markets over en

houdt de boel in de gaten, dit artikel nam ik over van Money and Markets:

Bonner:

The Feds and the Biggest Money Heist In History

Posted

by Bonner &

Partners | Jan 28, 2020 | News

Inflation

is always and everywhere a rip-off. –

Bill Bonner

BALTIMORE, MARYLAND —

The nice thing about inflation, at least from the feds’ point of

view, is that it doesn’t leave fingerprints.

Today’s dollar, for

example, is worth only three cents of the pre-1971 dollar. But who

dunnit? Who stole 97 cents out of every dollar?

New-Buck Scam

People thought the

switch to a new buck in 1971 was just a “technical” move. Still

do. But there was a big difference. The old dollar was a killjoy. The

feds just couldn’t have much fun with it. But the new one was like

an inflatable sex toy — it would go along with anything.

And when the first

wave of consumer price inflation hit in the ’70s, few people

understood what had happened. They thought the Arabs had pulled a

fast one. But as we saw last week (catch up here and here),

the First Oil Shock only returned the real price to where it had been

before the feds’ funny-money printing began.

Investors didn’t

notice their pockets were being picked either. In new dollars, the

Dow barely moved throughout the ’70s. But it lost 92% of its real

value.

And still today, only

you… and we… seem to realize how the Federal Reserve’s money

printing and ultralow interest rate policies (from 2009 to 2015) put

$20-some trillion into the pockets of the richest people in the

country.

Most people got

nothing from it. And relatively, the poor got poorer as the rich got

richer.

The bottom 50% of the population are actually 30% poorer

today than they were in 1999 — even using the feds’ phony

inflation calculator.

But does anyone blame

the real culprits? Nope. They blame the Mexicans and the Chinese.

Do

they vote for someone who pledges to end inflation? Or someone who

calls for more of it?

It doesn’t matter

whether the inflation goes into the capital markets or the consumer

economy… it works the same way, like a thief in the night. And now

underway is probably the biggest heist in history…

Like

a Street Mugging

Milton Friedman was

wrong about inflation. It is “always and everywhere a monetary

phenomenon,” said he. But that misses the point of it. A shooting

star is a phenomenon. So is irritable bowel syndrome; nobody is sure

what causes it.

But inflation is no

more a “phenomenon” than a street mugging; it is done for a

reason, to transfer wealth from some people to other people. It’s a

way for the feds — and their clients, cronies, and hangers-on —

to get more than taxpayers are willing to give them.

If they tried to

support their boondoggles and jackass programs by direct taxation

alone, there would soon be mobs gathered in the Capitol, with pitch

bubbling and rails at-the-ready.

But inflation?

Here at the Diary,

we guess about a great number of things — always trying to connect

the dots. We’ve been at it for so long, we’ve probably been wrong

about most everything. We’ll get to the rest in due course.

But one thing we’re

probably not wrong about is inflation. And when the Fed announced at

its December 2015 meeting that it would stop inflating and

“normalize” its monetary policy, we knew it was BS. Why?

With its ultralow

interest rates and its quantitative

easing (QE) programs, the Fed created a hothouse atmosphere. The

QE program alone gave some $3.6 trillion in new money to big

investors.

It was as if a very

rich person in a small town bid on all the houses that came up for

sale.

Prices rose. Everyone thought he had gotten richer. But take

away the reckless buyer, and the market would quickly adjust to

normal supply and demand pressures. Prices would fall back to

“normal.”

Falling prices would

cause the “wealth effect” to reverse into a “negative wealth

effect.” The economy would go into recession.

Keep

the Heat On

Either you keep

feeding warm air into the hothouse… or the orchids die. Greenspan,

Bernanke, Yellen, and now Powell — have all kept the heat on.

The last Fed chief to

turn off the heat was the recently

deceased Paul Volcker. He saw the “Inflate-or-Die” trap. To

escape it in 1980, he raised the Fed’s key rate to 20%, cut off the

hot air, and opened the windows, causing the worst U.S. recession

since the Great Depression.

Naturally,

politicians, economists, and the press howled and whined. A mob even

burned Volcker in effigy on the Capitol steps. But inflation quickly

fell, from nearly 14% in 1980 to only 3.2% in 1983.

Years before, another

great Fed chief, William McChesney Martin, explained why a good

central banker is more likely to be branded a villain than a hero:

In the field

of monetary and credit policy, precautionary action to prevent

inflationary excesses is bound to have some onerous effects… Those

who have the task of making such policy don’t expect you to

applaud.

Tough

Love

It’s been 40 years

since Volcker’s tough love. Since then U.S. federal debt has gone

from under $1 trillion to $23 trillion.

The Dow, too, went

from under 1,000 to over 29,000. And the people willing to support an

honest central banker — traditional fiscal conservatives and Ronald

Reagan — have disappeared.

As for the old

conservatives, they went AWOL when Republicans realized that, in a

funny-money world, “deficits don’t matter.”

William McChesney

Martin died in 1998. (He was replaced at the Fed in 1970 when he

resisted the new-money plotters.) Paul Volcker died late last year.

Today, Fed jefes are

willing to go along with the gag, and are described by the popular

press as “saving the world” (Greenspan), or “heroes” with

“the courage to act” (Bernanke).

And the current U.S.

president is not worried about curbing inflation. He wants more of

it. Here’s the commander in chief commenting on the Fed’s brief

fling with prudence:

It was a

killer when they raised the rate. It was just a big mistake. And they

admit to it. They admit to it. I was right. I don’t wanna be right,

but I was right.

More to come…

Regards,

Bill

• This article

was originally published by Bonner & Partners. You can learn more

about Bill and Bill Bonner’s Diary right

here.

Zie ook het vervolg van dit artikel: ‘Bonner: How Paper Money Became the Means for Modern Inflation‘

===============================

* In Wikipedia spreekt men bij de eerste oliecrisis in 1973 over ‘een politieke actie van de arabieren gericht tegen het westen’, terwijl de olieprijs in dollars werd en wordt weergegeven, ofwel de arabieren kregen inderdaad veel minder voor hun olie, daar de inflatie destijds zelfs met dubbele cijfers groeide, zie het artikel hierboven….. Wikipedia……

Door de inflatie van de ‘petrodollar’ (ofwel de olieprijs in

dollars), was de prijs van olie op een veel lager niveau gekomen, waarop de

arabieren het westen maar vooral de VS ‘de bel aanbonden’ en begonnen met de vermindering van de olieproductie, zodat de prijs omhoog ging. De olieprijs werd overigens vanaf 1971 in dollars weergegeven. (al werd ook voor die tijd vooral naar de VS gekeken wat betreft de olieprijs, daar het land eerst de grootste olieleverancier was en later tot de grootste olieproducerende landen bleef behoren)